It's a theory many had guessed but yet to be proven, properties as an investmentwith its resilienceis indeed the winning performer that leaves all other instrumentsplaying a catch-up game.

It's the "Brick-and-Mortar" story, of things that aren't going away; real assets that is forever in controlled supply; a safe harbor for liquidity and added to that Singapore’s tenacious habit with savings & investments, all succeededthe stellar return of this asset class.

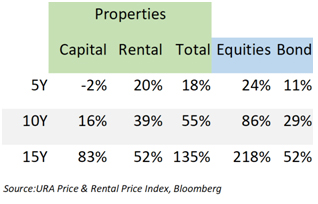

While equities at the time of writing are at the cusp of correction amidst global trades tension. Over a 15 years period, Singapore equities had more than doubled in total returns on a buy-and-hold strategy. This is contrasted to returns by the private residential properties market (incl. rental yield) of 135% and 50% total return of Singapore bonds over the same period.

So,what gives properties its winning edge?It is simple, because savings seldom work like that, precisely a buy-and-hold scenario that assumes a pocket of wealth available and invested at some starting point.

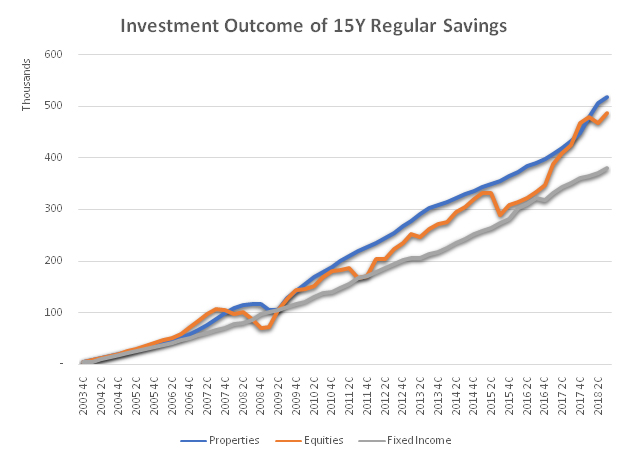

Savings in reality comes from disposable income out of household earnings and they are invested periodically in small amounts to accumulate over time. The flipside therefore of the tremendous equities returns is often times, a lot of gains were made in a relatively short period with lengthy corrections to follow. This has the implication that much of the high digit returns wereachieved only by investmentsleading up to the relevant rising seasons causing the eventual and overall outcome to be muted by volatilities. To this end, we examine a hypothetical savings plan where a household put aside $10,000 per quarter (growing at inflation rate) since 2003 and compare the investment outcome if these were fully invested in Singapore equities, fixed income & properties.

It is apparent properties shines as the leading asset class all due to its ability to produce consistent returns without the distractions. One may ask "who buys properties quarterly this way?", but is it impossible? Will fractional ownershipunlock this trove? Follow our next piece on current barriers to entry and affordability of the housing market.

by Herbert Woo Founder of MicroProperties

wherb@mymicroproperties.com

Disclaimer: This document is not an advertisement and does not constitute or form part of any offer or solicitation to issue, sell, subscribe or purchase any investment nor shall it or the fact of its distribution form the basis of or be relied on in connection with, any contract for the same. The contents in this document are for information, illustration or discussion purposes only and should not be construed as a recommendation to buy or sell any investment product and do not purport to represent or warrant the outcome of any investment product, strategy program or product. Reference to individual companies or any securities or funds is purely for the purpose of illustration only and is not and should not be construed as a recommendation to buy or sell, or advice in relation to investment, legal or tax matters.

Any research or analysis used to derive, or in relation to, the above information has been procured by MicroProperties for its own use, without considering the investment objectives, financial situation or particular needs of any specific investor, and may have been acted on for MicroProperties own purpose. MicroProperties does not warrant the accuracy, adequacy or completeness of the information herein and expressly disclaims liability for any errors or omissions. The information is given on a general basis without obligation and on the understanding that any person acting upon or in reliance on it, does so entirely at his or her own risk. Past performance is not indicative of future performance. Any projections or other forward-looking statements regarding future events or performance of countries, markets or companies are not necessarily indicative of, and may differ from, actual events or results. MicroProperties reserves the right to make changes and corrections to the information, including any opinions or forecasts expressed herein at any time, without notice. No reliance may be placed for any purpose on the information and opinions contained in this document or their accuracy or completeness. This document may not be reproduced in any form without the express permission of MicroProperties and to the extent it is passed on, care must be taken to ensure that this reproduction is in a form that accurately reflects the information presented here.