“Minpaku” 民泊are private lodging where the owner rent out a room or the whole home to travellers usually from popular websites such as Vacation stay and Airbnb. Japan has long had various similar accommodations mainly Minsuku and Ryokans, which should not be confused with Minpaku. Minsuku(民宿,in literal translation means “people inn”), are usually traditional Japanese homes where the owners stay in and doubles up to hosts travellers and Ryokans (旅館, in literal translation means “travel hall”), are popularised traditional Japan Inns that are operated as a hospitality business.

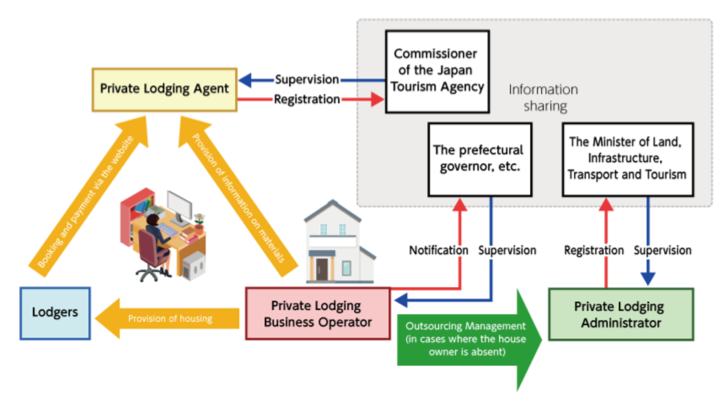

To address the prevalence of private lodgings in Japan, The Private Lodging Business Act became effective in June 2017 as a newly established law for setting rules for disseminating sound private lodging services. The new law states that to operate a Minpaku, the owner needs to notify the prefectural governor or similar, stating intention to operate such business. The new law also states that the total number of days operating as a Minpaku does not exceed 180 days a year, otherwise the owner faces a fine of 1million Yen if caught in violation of the law.

There is also a list of measures that one needs to follow to conduct a Minpaku, such as entrustment to private lodging agents if owner is absent, periodic reporting to prefecture governor (every 2 months) and ensuring the safety of lodgers, which includes the installation of emergency light equipment, display of evacuation route and most importantly to comply with fire safety regulations. These documentations are required to be submitted in order to get approval from the prefectural governor. You can read for more information at this link.

Source: https://www.mlit.go.jp/kankocho/minpaku/overview/minpaku/law1_en.html

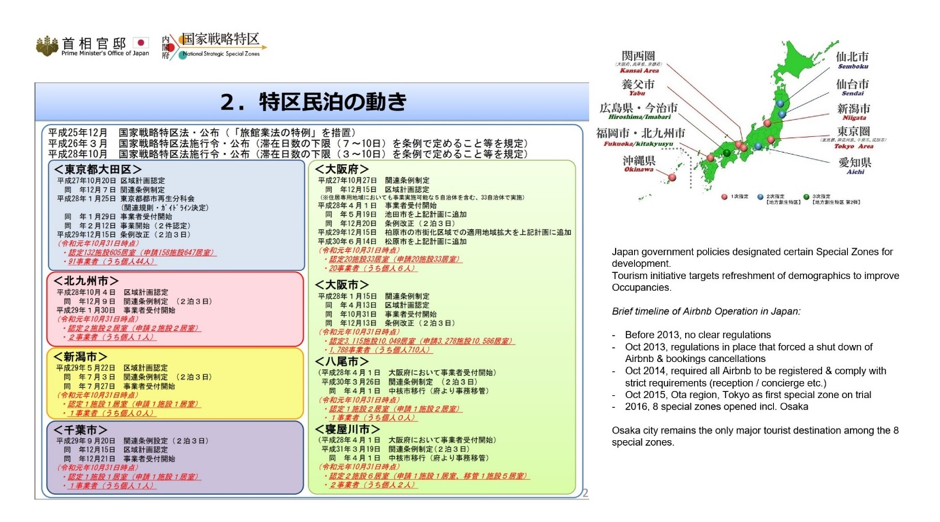

An exception to the above Private Lodging is Minpaku that have obtained authorization from certain local government that falls within the Special Zones. These National Strategic Special Zones aim to enhance economic growth by implementing regulatory reforms, and 10 areas are selected as the zones. Osaka city remains one of the major tourist destinations among the 10 special zones.

Source: http://www.kantei.go.jp/jp/singi/tiiki/kokusentoc/pdf/191031shiryou_tocminpaku.pdf

Operating a Minpaku in these “Special zones” has more relaxed restrictions that removes the limit on the number of stays per year and requirements to have a designated outsourced admin. As such, the Microproperties team are careful to curate a choice of properties predominantly in such “Special zones” or where there is viable Minpaku operations to generate higher returns for our investors.

Source: https://www.rethinktokyo.com/2018/06/13/how-legally-host-airbnb-japan-guide

Investing in an overseas property requires much research and the language barrier adds to its complexity in investing in Japan. Most of the documents and websites stipulating such regulations are in Japanese and sometimes things get lost in translation. Microproperties team has worked through the ground to understand the nitty gritty, with visits to Japan to understand the local climate (prior to Covid) and to date we have built a portfolio of three Minpaku in Osaka City. We hope the article above has provided you a summary of the regulatory and investment climate in Minpaku in Japan.

by Jessica Choy VP, Business Strategies

jessc@mymicroproperties.com

Disclaimer: This document is not an advertisement and does not constitute or form part of any offer or solicitation to issue, sell, subscribe or purchase any investment nor shall it or the fact of its distribution form the basis of or be relied on in connection with, any contract for the same. The contents in this document are for information, illustration or discussion purposes only and should not be construed as a recommendation to buy or sell any investment product and do not purport to represent or warrant the outcome of any investment product, strategy program or product. Reference to individual companies or any securities or funds is purely for the purpose of illustration only and is not and should not be construed as a recommendation to buy or sell, or advice in relation to investment, legal or tax matters.

Any research or analysis used to derive, or in relation to, the above information has been procured by MicroProperties for its own use, without considering the investment objectives, financial situation or particular needs of any specific investor, and may have been acted on for MicroProperties own purpose.

MicroProperties does not warrant the accuracy, adequacy or completeness of the information herein and expressly disclaims liability for any errors or omissions. The information is given on a general basis without obligation and on the understanding that any person acting upon or in reliance on it, does so entirely at his or her own risk. Past performance is not indicative of future performance. Any projections or other forward-looking statements regarding future events or performance of countries, markets or companies are not necessarily indicative of, and may differ from, actual events or results. MicroProperties reserves the right to make changes and corrections to the information, including any opinions or forecasts expressed herein at any time, without notice. No reliance may be placed for any purpose on the information and opinions contained in this document or their accuracy or completeness.

This document may not be reproduced in any form without the express permission of MicroProperties and to the extent it is passed on, care must be taken to ensure that this reproduction is in a form that accurately reflects the information presented here.