Japan, a country rich in culture of her nostalgic feudal past and robotic future; a land of abundance owed to the blessed terroir and a people who prides in their dedication to craft & service. It is no surprise the island nation is and always will be a top destination for travels of leisure, gastronomically and adventures.

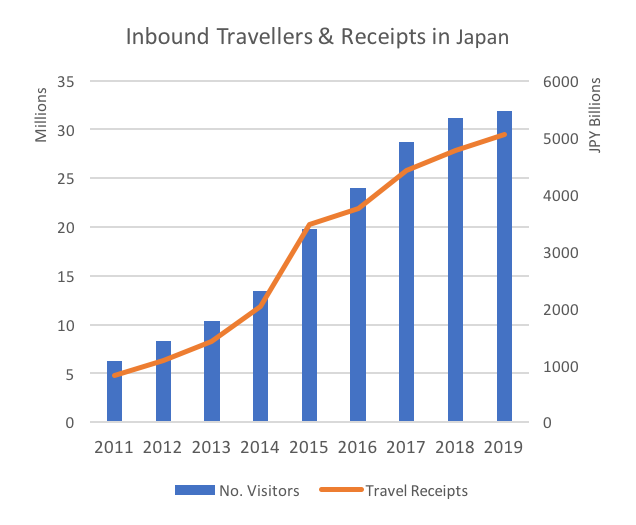

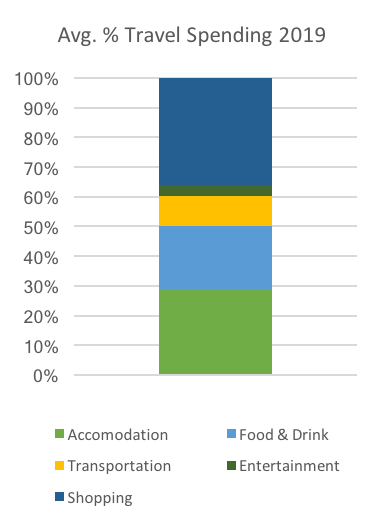

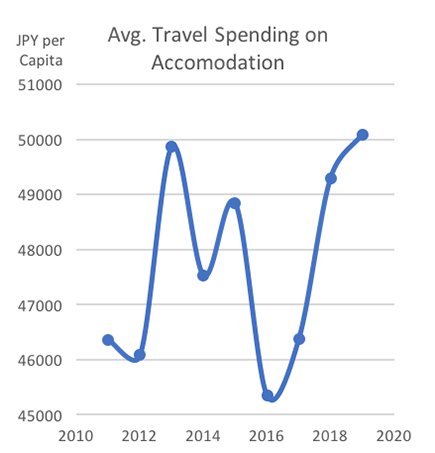

Before the present virus situation took hostage of the world, Japan had welcomed an estimate of 31.9m visitors in 2019 spending over JPY 5 trillion in travel consumptions. Much of that consumption invariably were spent on accommodation, which averaged 28.7%.

Source: Japan National Tourism Organization (JNTO)

As a platform for shared real estate investments, we are pleased to announce the relaunch of MicroProperties with a new initiative to target this specific market. A unique opportunity availed by technologies in holiday bookings and the regulation changes which legalised guesthouse operation for residential property in designated zones within Japan.

We have begun to curate a portfolio of landed residential homes that are remodelled for guesthouse operation around various tourism hotspots in Japan, starting with Osaka and there are some key elements to our investment approach.

Transformation

Our current portfolio targets individual landed homes known as “Machiya町家”, some with history that goes back more than a hundred years old. Part of the process in transforming these assets thus giving them a new life involves structurally refitting the architecture to match today’s fire & earthquake safety standards as required by Japan Ryokan Business Law & Residential Guesthouse Operations Law. In addition to this, elaborate stylistic interior designs are tailored for each property.

Operationally speaking, running individual homes as guesthouses ensures discrete enjoyment by our guests as well as keeping minimal disturbance to the neighbourhood (an essential aspect to guesthouse operations). The suite-like setting of these homely establishments also appeals to certain segment of travellers’ market with families.

While from an investment perspective, a portfolio approach enables the unparalleled diversification & flexibility to best capture trends in traveller’s preference & seasonality.

Decoupling from Deflation

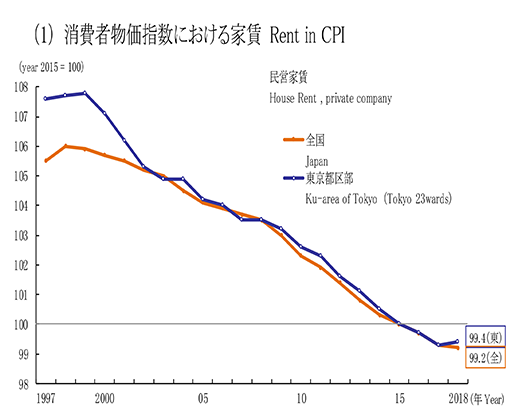

A much-studied economic condition that characterised Japan is none other than the deflation. It has been a decades long phenomenon which many political leaders had tried to abate and lately with a certain degree of success. But the widespread and prolonged effects of this deflation had already made profound impact on local consumer behaviour in Japan. The viscous cycle of an expectation for all things getting cheaper.

Source: Mitsui Fudosan

Source: Japan National Tourism Organization (JNTO)

With reference to the Rent in CPI chart, a hypothetical investment condo yielding 7% in 2010 would by 2018 if tenancy is renewed have its rental revised down by 3% in line with deflation of rental price. Needless to say, the property will have to compete with other newer condos for its tenancy.

Transforming local real estate into guesthouse in order to profit from foreign receipts therefore decouples local assets from deflation. This in our view is one way for a win-win proposition by taking advantage of a stabilised property price at a low base while pegging it to the naturally inflationary global holidays spending.

Distressed Opportunities

Besides the fundamental merits of guesthouse investment in Japan, the travel ban & lockdowns worldwide had taken its toll on the tourism industry and our team have so far been able to identify and execute on some mispriced assets in its course. These opportunities are often manifested by exiting players in the guesthouse business who succumbs to cashflow pressures from the current dire situations and we expect more to emerge well into next year.

by Herbert Woo Founder of MicroProperties

wherb@mymicroproperties.com

For enquiries, please contact hello@mymicroproperties.com

Disclaimer: This document is not an advertisement and does not constitute or form part of any offer or solicitation to issue, sell, subscribe or purchase any investment nor shall it or the fact of its distribution form the basis of or be relied on in connection with, any contract for the same. The contents in this document are for information, illustration or discussion purposes only and should not be construed as a recommendation to buy or sell any investment product and do not purport to represent or warrant the outcome of any investment product, strategy program or product. Reference to individual companies or any securities or funds is purely for the purpose of illustration only and is not and should not be construed as a recommendation to buy or sell, or advice in relation to investment, legal or tax matters.

Any research or analysis used to derive, or in relation to, the above information has been procured by MicroProperties for its own use, without considering the investment objectives, financial situation or particular needs of any specific investor, and may have been acted on for MicroProperties own purpose.

MicroProperties does not warrant the accuracy, adequacy or completeness of the information herein and expressly disclaims liability for any errors or omissions. The information is given on a general basis without obligation and on the understanding that any person acting upon or in reliance on it, does so entirely at his or her own risk. Past performance is not indicative of future performance. Any projections or other forward-looking statements regarding future events or performance of countries, markets or companies are not necessarily indicative of, and may differ from, actual events or results. MicroProperties reserves the right to make changes and corrections to the information, including any opinions or forecasts expressed herein at any time, without notice. No reliance may be placed for any purpose on the information and opinions contained in this document or their accuracy or completeness.

This document may not be reproduced in any form without the express permission of MicroProperties and to the extent it is passed on, care must be taken to ensure that this reproduction is in a form that accurately reflects the information presented here.